|

New Storage Options for the Small and Medium Business

Introduction

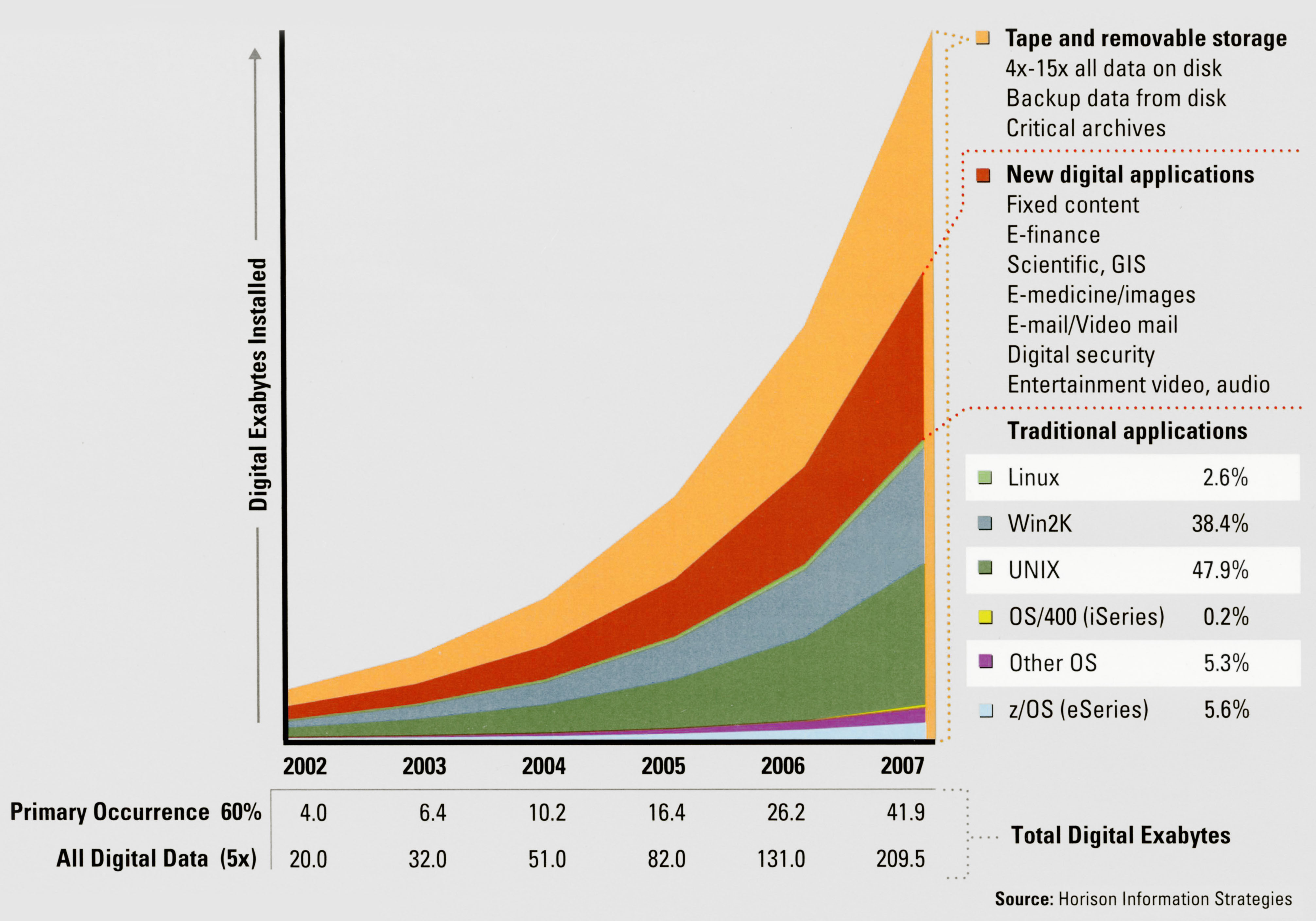

Historically, data generated by day-to-day business operations has grown by 50-70 percent annually. Until recently, this steady pressure has been met by the ever-increasing capacity of storage media. But today the storage market is undergoing rapid change and the storage requirements of businesses are growing even faster, driven by the convergence of three factors:

- The one-two punch of the dot-com bust and the events of 9/11 have drastically reduced budgets, starving businesses of the capital to upgrade their systems. For many firms, their last hardware refresh occurred in the 1998-1999 timeframe and the pent-up demand for replacing these older systems is growing daily.

- Technologies like Storage Area Networks that were exclusive to the enterprise just a few years ago have filtered down into more cost-sensitive SMB markets. By the same token, consumer-grade technologies like ATA drives are migrating into specialized areas of the enterprise.

- The economic fallout of some major accounting scandals has settled in the form of new rules and regulations, many of which require a major rethinking of the role of storage as firms struggle to understand and comply with new requirements.

A surge in spending on storage is taking place, with a market expected to surpass $47.6 billion by 2005. A significant portion of this capital is being directed at compliance with new rules and regulations, including Sarbanes-Oxley, SEC 17a-4, and HIPAA. Put simply, these new regulations involve increased accountability, data storage security, and data retention for much longer periods. It is difficult to overstate the impact of these laws, which affect thousands of public companies, brokerage firms, and healthcare providers – many of which are your customers. Do they have the necessary policies in place to deal with the new legislation? Do they have an extensible storage architecture that will serve them into the future?

The software and hardware refresh that accompanied Y2K has a counterpart in this wave of new legislation. It is an opportunity to introduce your customers to new storage solutions that address both the longstanding problems of data backup and recovery and the service of ever-greater amounts of data. This paper will describe a new storage model for the SMB space that will make information easier to manage and faster to restore, without halting servers or robbing network bandwidth. All this is achievable at costs far lower than ever before, providing economy to your customers while increasing the capacity and integrity of their storage.

The software and hardware refresh that accompanied Y2K has a counterpart in this wave of new legislation. It is an opportunity to introduce your customers to new storage solutions that address both the longstanding problems of data backup and recovery and the service of ever-greater amounts of data. This paper will describe a new storage model for the SMB space that will make information easier to manage and faster to restore, without halting servers or robbing network bandwidth. All this is achievable at costs far lower than ever before, providing economy to your customers while increasing the capacity and integrity of their storage.

Figure 1. Digital Storage Growth Projections (Click Figure to Enlarge)

< Previous Next >

|